Embarking on the journey to sell your business is a monumental decision that requires careful planning and execution. At Erben M&A, we believe that a successful sale begins with a strong foundation.

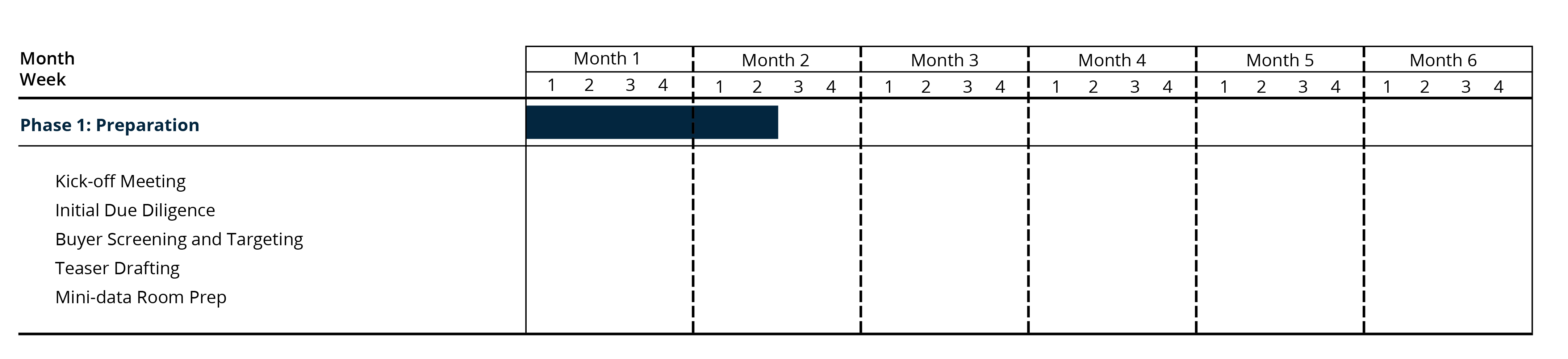

The first phase of our 5-phase project timeline is all about preparation. This phase lays the groundwork for a smooth and efficient sale process, ensuring that every detail is meticulously planned and executed. By laying out the Merger and Acquisition process step by step, we aim to make our Five Step Process clear and understandable for you and your business, so that you may effectively go through the procedures of selling your business.

The preparation phase starts with a kick-off meeting. This meeting aligns all team members, sets expectations, and outlines the timeline and key resource requirements. It ensures everyone understands their roles and the overall objectives, providing a clear roadmap for the process ahead.

Next, we conduct a thorough analysis and review of your company’s due diligence materials. This step identifies potential issues and gathers all necessary information before reaching out to potential buyers. It involves a comprehensive review of financials, operations, legal matters, and more, allowing us to proactively address any red flags.

We then work with your team to finalize an initial list of potential buyers. This collaborative approach targets the most suitable buyers based on industry fit, financial capability, strategic alignment, and interest in your type of business. By carefully selecting potential buyers, we enhance the chances of a successful match.

Following the buyers list, we prepare the teaser, a two-page document. It provides an overview of your company and the sale opportunity without revealing your company’s identity. The teaser highlights key aspects of your business to generate interest among potential buyers, serving as an enticing introduction.

The final step in the preparation phase is the set-up of a mini data room. The mini data room contains critical due diligence materials that allow prospective buyers to quickly review the critical information needed to determine valuation ranges. The mini data room includes the following materials:

Historical Financials

(Last 3 Years + YTD Period)

Corporate Overview

Presentation Deck

Operating Metrics/KPIs

(Last 3 Years + YTD Period)

Financial Budget

(Next 1 – 2 Fiscal Years)

Employee Census

(Redacted)

Revenue & Margin by Customer/Project

(Redacted, Last 3 Years +

YTD Period)

Company Capitalization Table

(Redacted)

Product/Service

Overview Information

By setting up a mini data room, we ensure that potential buyers have access to the critical information they need to make informed decisions about your business. This step is crucial for building trust and credibility with potential buyers and ensuring that the sale process moves forward smoothly.

The preparation phase is a critical step in the sale process. By laying a strong foundation, we ensure that the entire process is streamlined and efficient. From the initial kick-off meeting to the set-up of the mini data room, each step is designed to gather the necessary information, identify potential issues, and engage the right buyers.

At Erben M&A, we are committed to guiding you through each phase with expertise and personalized support. If you’re considering selling your business or need assistance with an M&A transaction, contact us today to learn how we can help. Let us assist you in achieving the best possible outcome for your business.